The recent market rebound witnessed a widespread increase in cryptocurrency prices, with nearly all cryptocurrencies in the Coindesk Market Index experiencing gains over the past 24 hours. Notably, funding rates for certain altcoins and memecoins plunged into deeply negative territory, potentially setting the stage for a rapid upward movement driven by a short squeeze, as highlighted by QCP Capital.

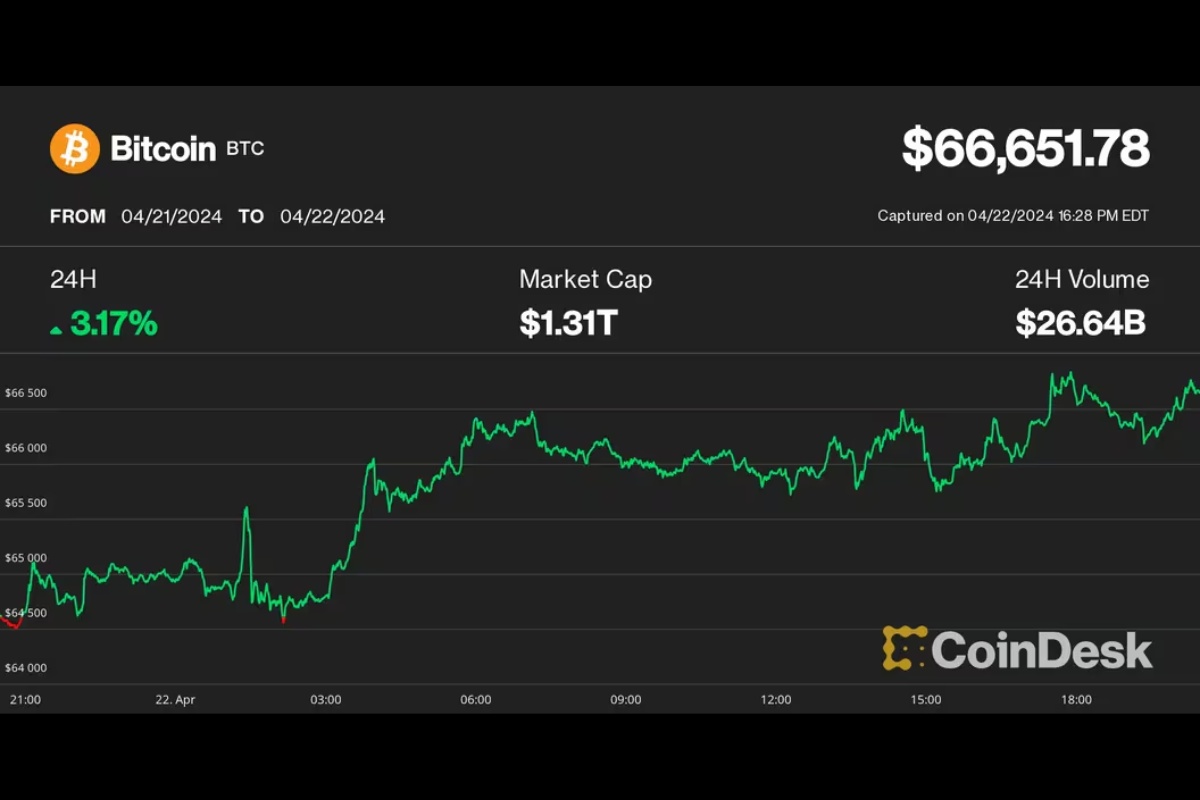

Bitcoin approached the $67,000 mark, marking a 3% surge over the past day following its quadrennial halving event, which halved the issuance of new supply. Meanwhile, Ether remained steady around $3,200, showing a modest 1.5% increase during the same period.

The positive momentum extended across the crypto market, with 163 out of 173 cryptocurrencies in the CoinDesk Market Index posting positive daily returns. The CoinDesk 20 Index (CDI) surged over 3%, with Near Protocol’s native token (NEAR) leading the gains with a 15% increase.

Digital asset-focused stocks also witnessed a rally, with shares of crypto exchange Coinbase (COIN) and MicroStrategy (MSTR) climbing 7% and 12%, respectively. Publicly listed miners Riot Platforms (RIOT), Hut 8 (HUT), and Marathon Digital (MARA) also saw significant gains ranging from 6% to 20%.

While some analysts express caution regarding potential market weakness in the short term due to miners offloading their BTC inventory following the halving event, historical patterns suggest a potential exponential increase in bitcoin’s price in the coming weeks. QCP Capital highlights the cooling off of funding rates, particularly for leveraged derivatives traders, which could trigger a short squeeze, especially for altcoins and memecoins with deeply negative funding rates, potentially leading to a resurgence in speculative sentiment and a resumption of leveraged long positions.

Source: coindesk.com

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.