Real-World Assets (RWAs) in cryptocurrency represent a rapidly evolving sector that bridges traditional finance with decentralized finance (DeFi). These digital tokens correspond to tangible or financial assets outside the blockchain, such as real estate, commodities, bonds, and even carbon credits. The process of tokenization, which involves converting these real-world assets into digital tokens on a blockchain, offers significant benefits, including enhanced liquidity, accessibility, transparency, and reduced transaction costs.

Top RWA Protocols in 2024

Here are some of the leading projects in this space:

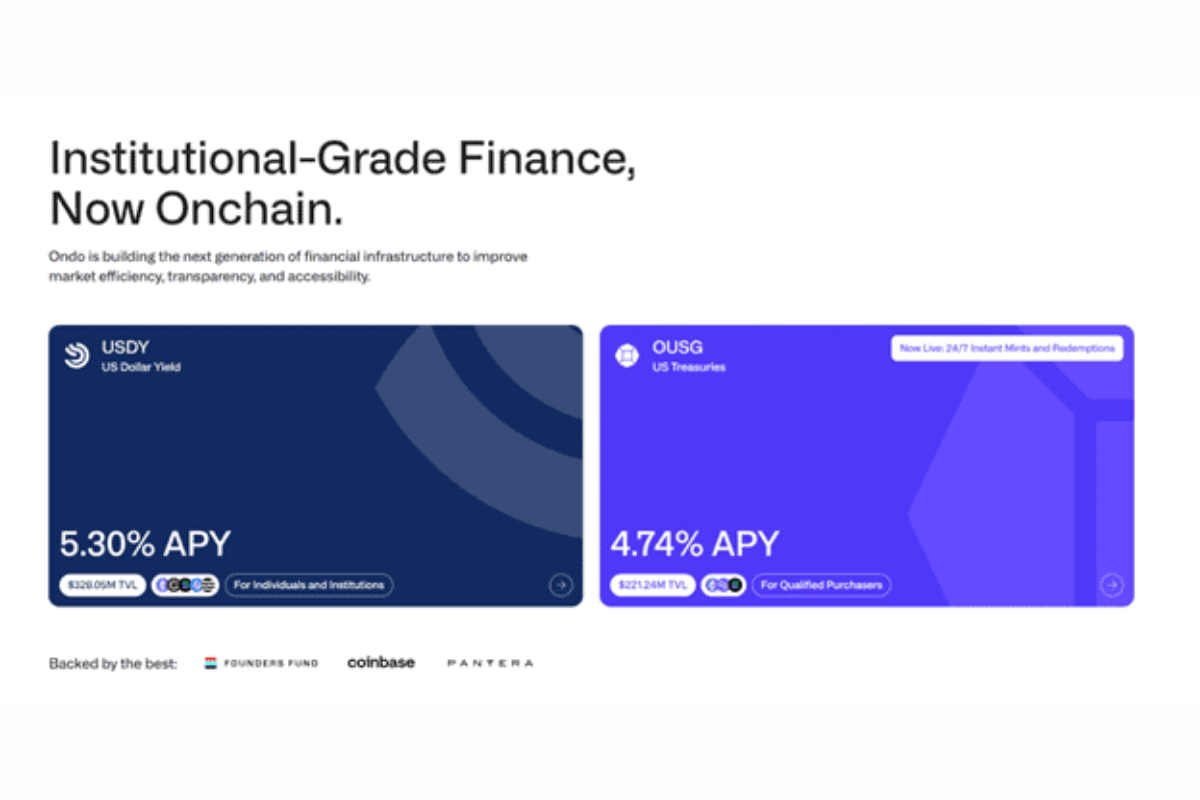

1. Ondo Finance:

– Focus: Tokenizing stable, yield-generating assets from traditional finance, like US Treasuries.

– Key Features: Offers products like tokenized versions of BlackRock ETFs and introduces yield-bearing stablecoins.

– Security: Backed by security audits and runs KYC checks for compliance.

– Stakeholders: Governed by ONDO stakeholders and operates through the Ondo Foundation and DAO.

2. Centrifuge:

– Focus: Lowering capital costs for SMEs by tokenizing assets like invoices and real estate.

– Key Features: Decentralized governance, integration with DeFi protocols like MakerDAO, and offers diversified, stable yields backed by real-world assets.

3. RealT:

– Focus: Fractional ownership of US real estate through tokenization.

– Key Features: Allows global investors to purchase shares of US properties, ensuring blockchain-secured passive income.

4. OpenEden:

– Focus: Exposing investors to US Treasury bills through blockchain.

– Key Features: TBILL Vault allows minting of TBILL tokens backed by US Treasuries, offering liquidity and transparency.

– Compliance: Operates under strict KYC and AML procedures.

5. Maple Finance:

– Focus: Providing high-quality, overcollateralized lending opportunities.

– Key Features: Targets institutional borrowers, offering superior yields and cash management through tokenized assets.

6. stUSDT:

– Focus: Tokenizing US Treasury Bills on the TRON blockchain.

– Key Features: Offers passive income through tokenized real-world assets with instant settlement on the JustLend platform.

7. Tangible:

– Focus: Tokenizing physical assets like real estate into TNFTs.

– Key Features: Provides a stablecoin (USDR) backed by real estate, offering fractional ownership and consistent yields.

8. Mountain Protocol:

– Focus: Yield-bearing stablecoin backed by U.S. Treasury Bills.

– Key Features: USDM token provides a 5% yield, with transparency and compliance at its core.

9. Solv Protocol:

– Focus: Tokenizing high-quality yields through innovative financial NFTs.

– Key Features: Introduces Liquid Yield Tokens and vouchers, offering a new class of digital assets.

10. SuperState:

– Focus: Tokenizing U.S. Treasury securities to modernize traditional finance.

– Key Features: Offers tokenized Treasury funds, integrated with DeFi for seamless management of assets.

Benefits and Challenges

Benefits:

– Accessibility: Allows fractional ownership, making traditionally illiquid assets more accessible.

– Liquidity: Provides higher liquidity by enabling 24/7 trading and transactions.

– Transparency: Ensures all information is recorded on the blockchain, reducing the risk of fraud.

– Cost Efficiency: Reduces transaction costs by eliminating intermediaries.

Challenges:

– Regulatory Compliance: Protocols must navigate varying laws across jurisdictions, making compliance critical to their success.

– Security and Trust: The integration of traditional finance and DeFi requires robust security measures to ensure the trustworthiness of tokenized assets.

Future Prospects

The market for tokenized real-world assets is projected to grow significantly, potentially reaching trillions in value, according to reports by Boston Consulting Group and others. As these protocols continue to innovate and adapt to regulatory requirements, they are likely to play a pivotal role in the convergence of traditional and decentralized finance, paving the way for a more inclusive and efficient global financial system.

Source: cryptopotato.com

Got a Questions?

Find us on Socials or Contact us and we’ll get back to you as soon as possible.